Pay of Debt

Debt snowball method and Velocity banking method

Method # 1 Debt snowball

The debt snowball method is a popular strategy for paying off debt. Here’s how it works, step by step:

- List Your Debts: Make a list of all your debts, including the outstanding balance, minimum monthly payment, and interest rate.

- Order Your Debts: Arrange your debts from smallest to largest balance.

- Make Minimum Payments: Continue making the minimum payments on all your debts except the smallest one.

- Pay Extra on Smallest Debt: Allocate any extra money you have each month to the smallest debt. Pay as much as you can afford.

- Repeat: Once the smallest debt is paid off, take the amount you were paying on it (minimum payment plus extra) and apply it to the next smallest debt.

- Continue: Repeat this process until all your debts are paid off.

The idea behind the debt snowball method is to build momentum by paying off the smallest debts first, which can give you a sense of accomplishment and motivate you to keep going.

Method # 2 Velocity Banking

Velocity banking is a financial strategy that involves using a line of credit to pay off debt more quickly. Here’s how it works, step by step:

- Understand the Concept: Velocity banking relies on the idea of using a line of credit (such as a home equity line of credit or personal line of credit) to pay off debts. By doing this, you can reduce the amount of interest you pay over time and pay off your debts more quickly.

- Get a Line of Credit: If you don’t already have a line of credit, you’ll need to apply for one. Make sure to shop around for the best interest rate and terms.

- List Your Debts: Make a list of all your debts, including the outstanding balance, minimum monthly payment, and interest rate.

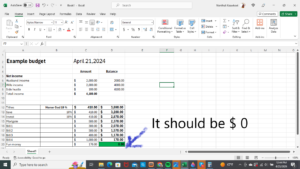

- Calculate Your Cash Flow: Determine your monthly income and expenses to understand how much money you have available to put toward your debts.

- Use Your Line of Credit: Use your line of credit to pay off the debt with the highest interest rate first. This is typically a credit card or other high-interest debt.

- Apply Extra Cash Flow: Use any extra money you have each month to make additional payments on your line of credit. This helps to reduce the balance more quickly.

- Repeat: Once the first debt is paid off, move on to the next highest interest rate debt and repeat the process.

- Monitor Your Progress: Keep track of your progress to see how much you’re saving in interest and how quickly you’re paying off your debts.

- Be Consistent: The key to velocity banking is to be consistent with your payments and to continue using your line of credit to pay off debts until they’re all paid off.

It’s important to note that velocity banking requires discipline and careful planning. If you’re considering this strategy, it’s a good idea to consult with a financial advisor to make sure it’s the right choice for your financial situation.

Get organize and get the debt tracker here

Key Takeaway 👍

When I came across Vann YouTube one day. I was in a situation with a lot of debt. I give Velocity banking a try. It seems to help with cash flow and also increase a credit score.